On Oct. 22, 2023, the country of Argentina will vote on who becomes their next president. Like the United States, the head of state gets reelected every four years via a general vote and they operate primarily on a two party system. However, this particular election resembles the United States even more strikingly; the far-right Libertarian candidate and current favorite in the national polls, Javier Milei, is proposing the dollarization of the Argentine economy and removal of their country’s central bank — ideas that international journalists and global economists alike claim to have been inspired by former U.S. President Donald Trump.

Dollarization, which is described by the Corporate Finance Institute as a process “by which a country decides to use two currencies – the local currency and generally a stronger, more established currency like the US dollar. A dollarization process can either be partially or completely done.” Milei is calling for a complete dollarization process of the Argentine economy in order to stabilize it after years of turmoil and financial inconsistency.

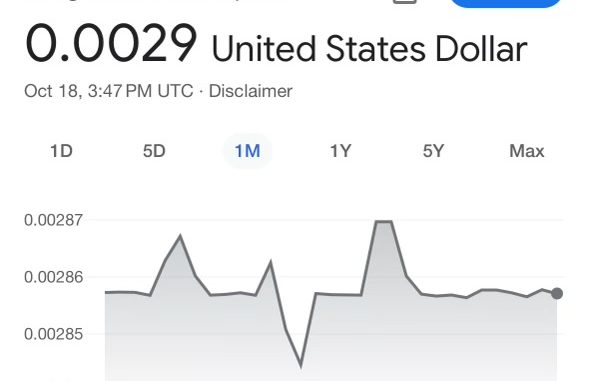

Milei’s drastic ideas are well-received by the general public due to the sharp decrease in value that the Argentine peso has taken in the global markets over the past year — and, more alarmingly, in the past week. Though the official rate remains fixed at 350 Argentine pesos per U.S. dollar, the informal rate was priced at around 850 pesos to USD in September and has spiked up to nearly 1,000 pesos according to data from Oct. 16.

“The Argentine peso is so wildly unstable — it’s unreal,” says second-year Elena Swartz, whose extended family lives in Argentina and has even lived there herself a decade ago. “All the Argentines I know don’t keep their money in a bank but instead keep it in physical U.S. dollars because they live in fear that they could literally wake up one morning and all their money is suddenly worthless.”

Milei, who describes himself as an “anarcho-capitalist” has been quoted on multiple occasions talking about how ineffective the peso is. On Oct. 9, the “outsider politician” went on a popular Argentinian radio station named Radio Mitre and discouraged Argentinians from holding any of their investments in pesos. “The peso is the currency issued by the Argentine politician and therefore is worth less than excrement,” said Milei confidently. “That trash is not even good as manure.”

Two days later, on Oct. 11, the current Argentine president Alberto Fernández filed an official judiciary complaint against the outspoken candidate to have him investigated for “public intimidation,” which is in direct violation of Article 211 of the Argentine Criminal Code. The code qualifies public intimidation as “giving alarm voices, making signs or using other material means to instill public fear or stir up tumult or disorder,” which incites a prison sentence of two to six years. Fernández’s argument is that the peso reached an all-time high of 1,050 pesos to one USD the very next day following Milei’s Radio Mitre appearance.

“The population was frightened about the real possibility that our currency, the peso, will not maintain its value and will continue to be the monetary sign of the country,” says Fernández in the official complaint, obtained by La Prensa Latina reporters.

Though the dollarization process has many pros – such as allowing smaller countries to compete more efficiently in global markets and encouraging international businesses to set up localized offices within their borders – it comes with a slew of cons that range far beyond the economic sector. Culturally, it may imply the Americanization of Argentina in which local and national heritage could become second-class to U.S. ideals and trends.

“I do notice a lot of Americans moving to Argentina because the American dollar is worth so much,” says Swartz. “It’s actively causing problems. Say someone is in my position, someone who speaks both English and Spanish really well and they live in Argentina. Say they teach Spanish tutoring over Zoom for students in America and they charge like $20 an hour in USD, which is a very reasonable price to pay for private lessons and is way less than most people pay. Now, say this person teaches three to four lessons a week. This person can live incredibly comfortably in Argentina because nothing is going to cost them that much when compared to American prices. Americans can get by super easily in a place where Argentinians are struggling economically, and the Americans survive economic collapses while actual native citizens of a given country get screwed over.”

With American influence already prominent in Argentina, the dollarization process may bring some financial stability, but it will come at the cost of Argentine autonomy and will give the USD political power and influence over the financially-burdened country.